Roll Forming

Roll Forming

Case Study: How Steel Properties Influence the Roll Forming Process

Coil Shape Imperfections Influencing Roll Forming

Roll Stamping

Roll Forming

Roll Forming takes a flat sheet or strip and feeds it longitudinally through a mill containing several successive paired roller dies, each of which incrementally bends the strip into the desired final shape. The incremental approach can minimize strain localization and compensate for springback. Therefore, roll forming is well suited for generating many complex shapes from Advanced High-Strength Steels, especially from those grades with low total elongation, such as martensitic steel. The following video, kindly provided by Shape Corp.S-104, highlights the process that can produce either open or closed (tubular) sections.

The number of pairs of rolls depends on the sheet metal grade, finished part complexity, and the design of the roll-forming mill. A roll-forming mill used for bumpers may have as many as 30 pairs of roller dies mounted on individually driven horizontal shafts.A-32

Roll forming is one of the few sheet metal forming processes requiring only one primary mode of deformation. Unlike most forming operations, which have various combinations of forming modes, the roll-forming process is nothing more than a carefully engineered series of bends. In roll forming, metal thickness does not change appreciably except for a slight thinning at the bend radii.

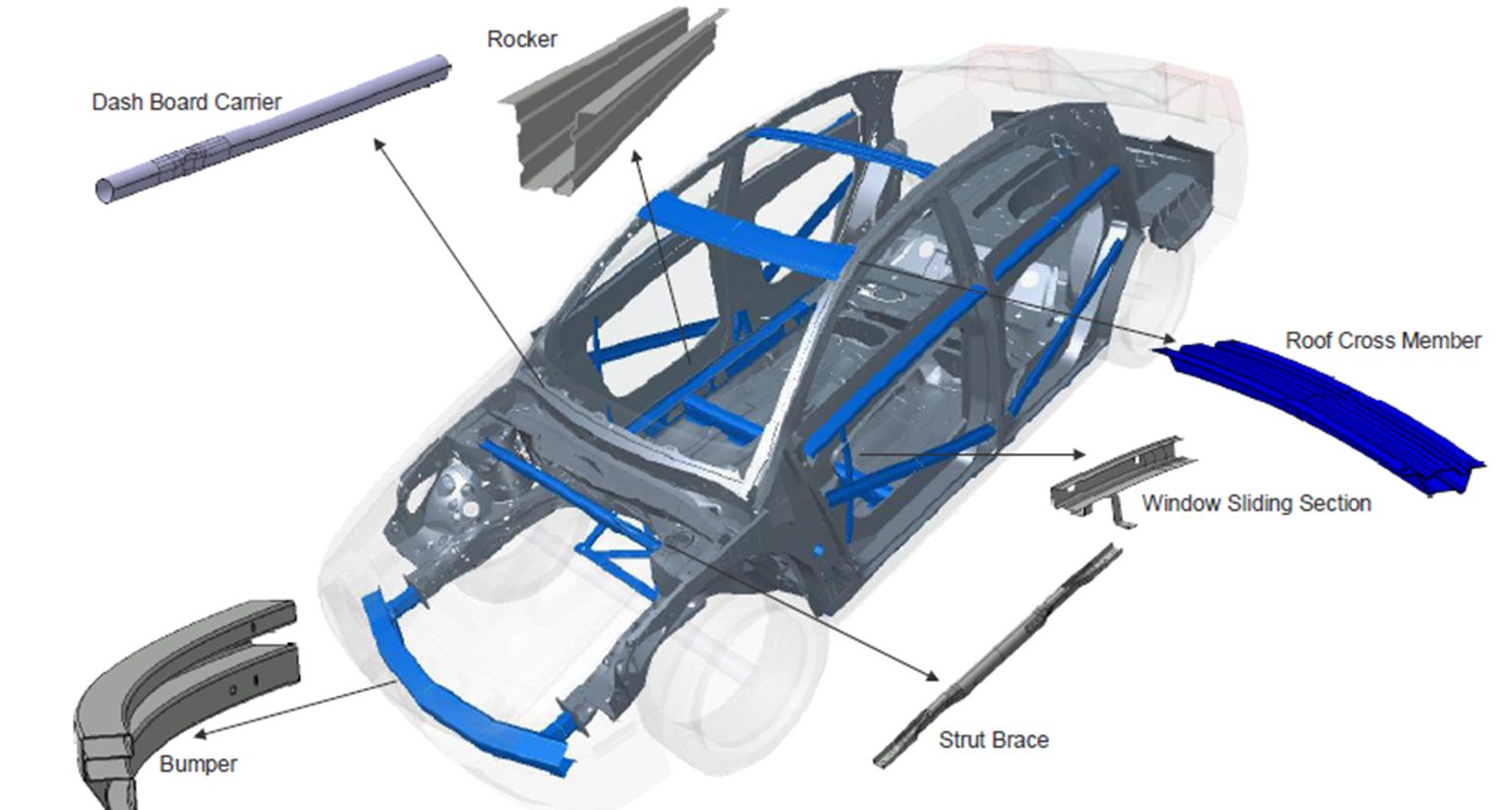

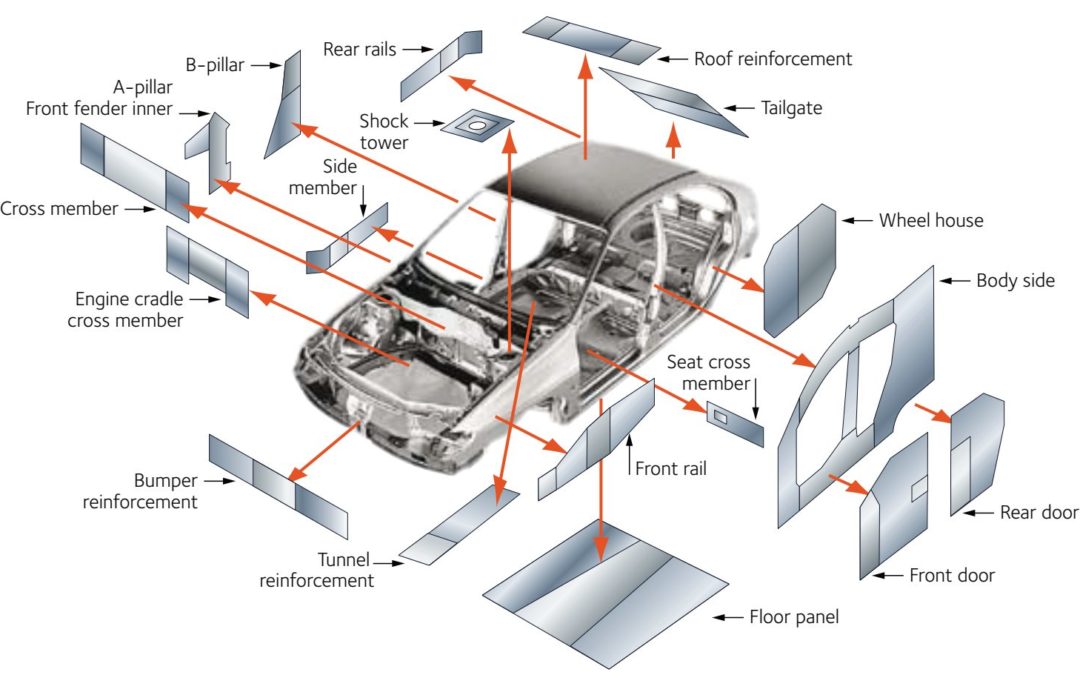

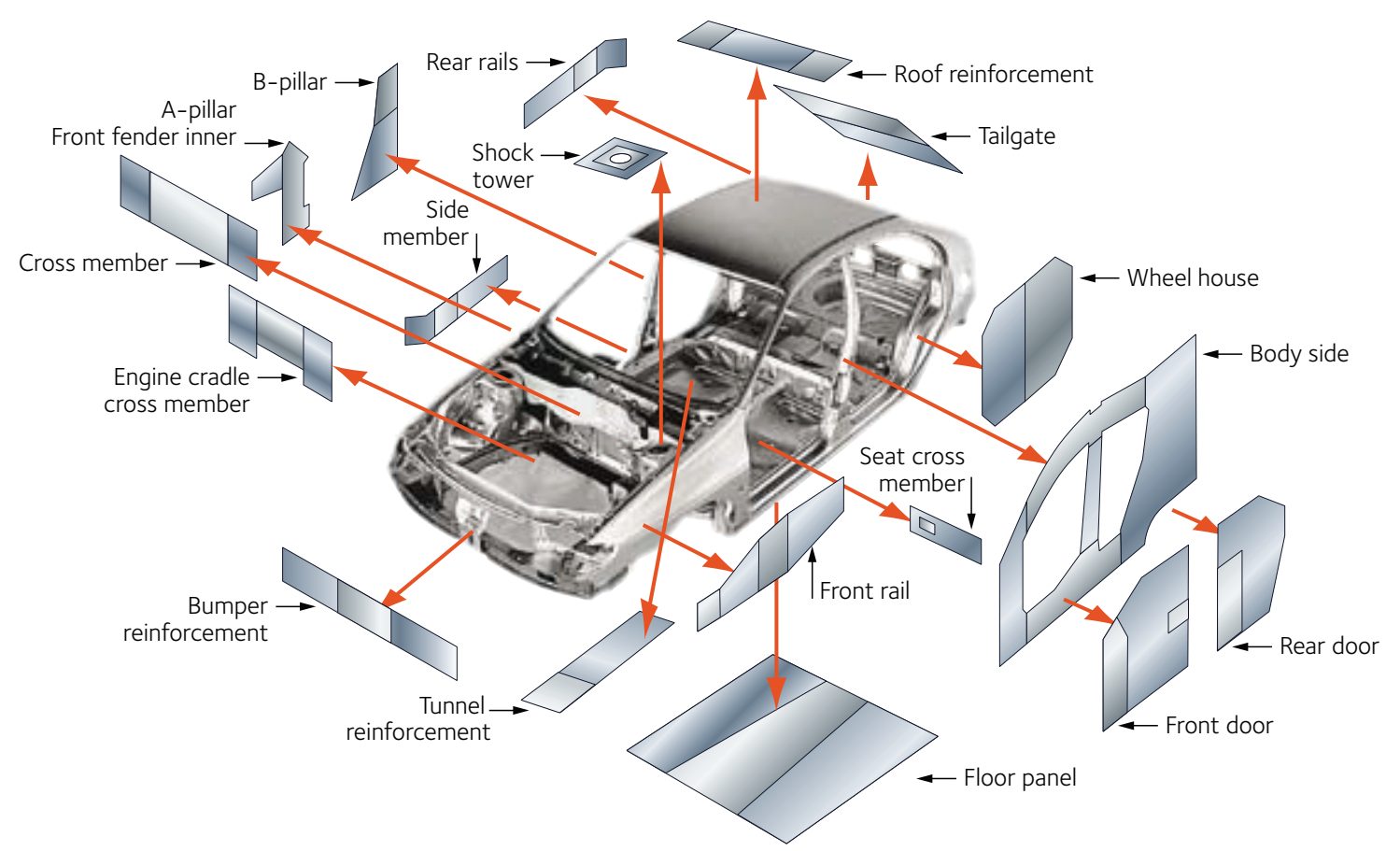

Roll forming is appropriate for applications requiring high-volume production of long lengths of complex sections held to tight dimensional tolerances. The continuous process involves coil feeding, roll forming, and cutting to length. Notching, slotting, punching, embossing, and curving combine with contour roll forming to produce finished parts off the exit end of the roll-forming mill. In fact, companies directly roll-form automotive door beam impact bars to the appropriate sweep and only need to weld on mounting brackets prior to shipment to the vehicle assembly line.A-32 Figure 1 shows an example of automotive applications that are ideal for the roll-forming process.

Roll forming can produce AHSS parts with:

- Steels of all levels of mechanical properties and different microstructures.

- Small radii depending on the thickness and mechanical properties of the steel.

- Reduced number of forming stations compared with lower strength steel.

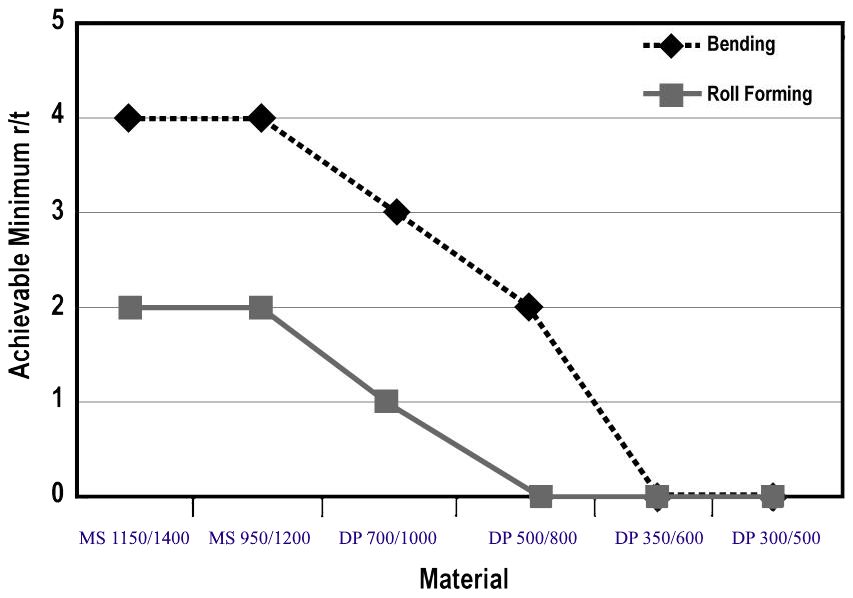

However, the high sheet-steel strength means that forces on the rollers and frames in the roll-forming mill are higher. A rule of thumb says that the force is proportional to the strength and thickness squared. Therefore, structural strength ratings of the roll forming equipment must be checked to avoid bending of the shafts. The value of minimum internal radius of a roll formed component depends primarily on the thickness and the tensile strength of the steel (Figure 2).

Figure 2: Achievable minimum r/t values for bending and roll forming for different strength and types of steel.S-5

As seen in Figure 2, roll forming allows smaller radii than a bending process. Figure 3 compares CR1150/1400-MS formed with air-bending and roll forming. Bending requires a minimum 3T radius, but roll forming can produce 1T bends.S-30

Figure 3: CR1150/1400-MS (2 mm thick) has a minimum bend radius of 3T, but can be roll formed to a 1T radius.S-30

The main parameters having an influence on the springback are the radius of the component, the sheet thickness, and the strength of the steel. As expected, angular change increases for increased tensile strength and bend radius (Figure 4).

Figure 4: Angular change increases with increasing tensile strength and bend radii.A-4

Figure 5 shows a profile made with the same tool setup for three steels at the same thickness having tensile strength ranging from 1000 MPa to 1400 MPa. Even with the large difference in strength, the springback is almost the same.

Figure 5: Roll formed profile made with the same tool setup for three different steels. Bottom to Top: CR700/1000-DP, CR950/1200-MS, CR1150/1400-MS.S-5

Citation A-33 provides guidelines for roll forming High-Strength Steels:

- Select the appropriate number of roll stands for the material being formed. Remember the higher the steel strength, the greater the number of stands required on the roll former.

- Use the minimum allowable bend radius for the material in order to minimize springback.

- Position holes away from the bend radius to help achieve desired tolerances.

- Establish mechanical and dimensional tolerances for successful part production.

- Use appropriate lubrication.

- Use a suitable maintenance schedule for the roll forming line.

- Anticipate end flare (a form of springback). End flare is caused by stresses that build up during the roll forming process.

- Recognize that as a part is being swept (or reformed after roll forming), the compression of metal can cause sidewall buckling, which leads to fit-up problems.

- Do not roll form with worn tooling, as the use of worn tools increases the severity of buckling.

- Do not expect steels of similar yield strength from different steel sources to behave similarly.

- Do not over-specify tolerances.

Guidelines specifically for the highest strength steelsA-33:

- Depending on the grade, the minimum bend radius should be three to four times the thickness of the steel to avoid fracture.

- Springback magnitude can range from ten degrees for 120X steel (120 ksi or 830 MPa minimum yield strength, 860 MPa minimum tensile strength) to 30 degrees for M220HT (CR1200/1500-MS) steel, as compared to one to three degrees for mild steel. Springback should be accounted for when designing the roll forming process.

- Due to the higher springback, it is difficult to achieve reasonable tolerances on sections with large radii (radii greater than 20 times the thickness of the steel).

- Rolls should be designed with a constant radius and an evenly distributed overbend from pass to pass.

- About 50 percent more passes (compared to mild steel) are required when roll forming ultra high-strength steel. The number of passes required is affected by the number of profile bends, mechanical properties of the steel, section depth-to-steel thickness ratio, tolerance requirements, pre-punched holes and notches.

- Due to the higher number of passes and higher material strength, the horsepower requirement for forming is increased.

- Due to the higher material strength, the forming pressure is also higher. Larger shaft diameters should be considered. Thin, slender rolls should be avoided.

- During roll forming, avoid undue permanent elongation of portions of the cross section that will be compressed during the sweeping process.

Roll forming is applicable to shapes other than long, narrow parts. For example, an automaker roll forms their pickup truck beds allowing them to minimize thinning and improve durability (Figure 6). Reduced press forces are another factor that can influence whether a company roll forms rather than stamps truck beds.

Figure 6: Roll Forming can replace stamping in certain applications.G-9

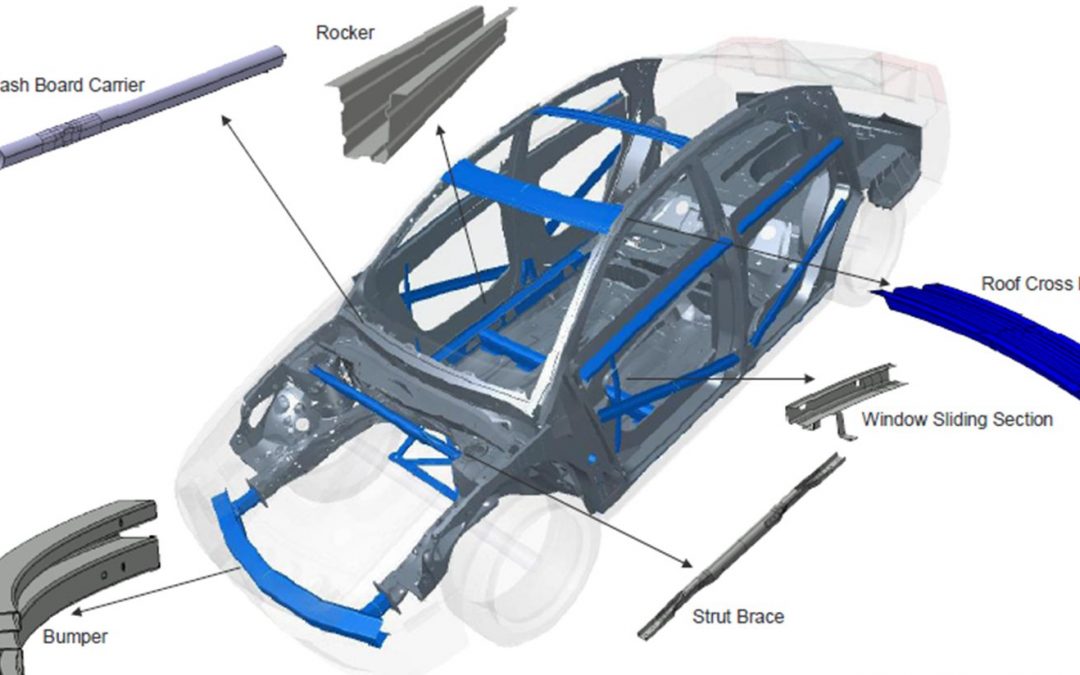

Traditional two-dimensional roll forming uses sequential roll stands to incrementally change flat sheets into the targeted shape having a consistent profile down the length. Advanced dynamic roll forming incorporates computer-controlled roll stands with multiple degrees of freedom that allow the finished profile to vary along its length, creating a three-dimensional profile. The same set of tools create different profiles by changing the position and movements of individual roll stands. In-line 3D profiling expands the number of applications where roll forming is a viable parts production option.

One such example are the 3D roll formed tubes made from 1700 MPa martensitic steel for A-pillar / roof rail applications in the 2020 Ford Explorer and 2020 Ford Escape (Figure 7). Using this approach instead of hydroforming created smaller profiles resulting in improved driver visibility, more interior space, and better packaging of airbags. The strength-to-weight ratio improved by more than 50 percent, which led to an overall mass reduction of 2.8 to 4.5 kg per vehicle.S-104

Figure 7: 3D Roll Formed Profiles in 2020 Ford Vehicles using 1700 MPa martensitic steel.S-104

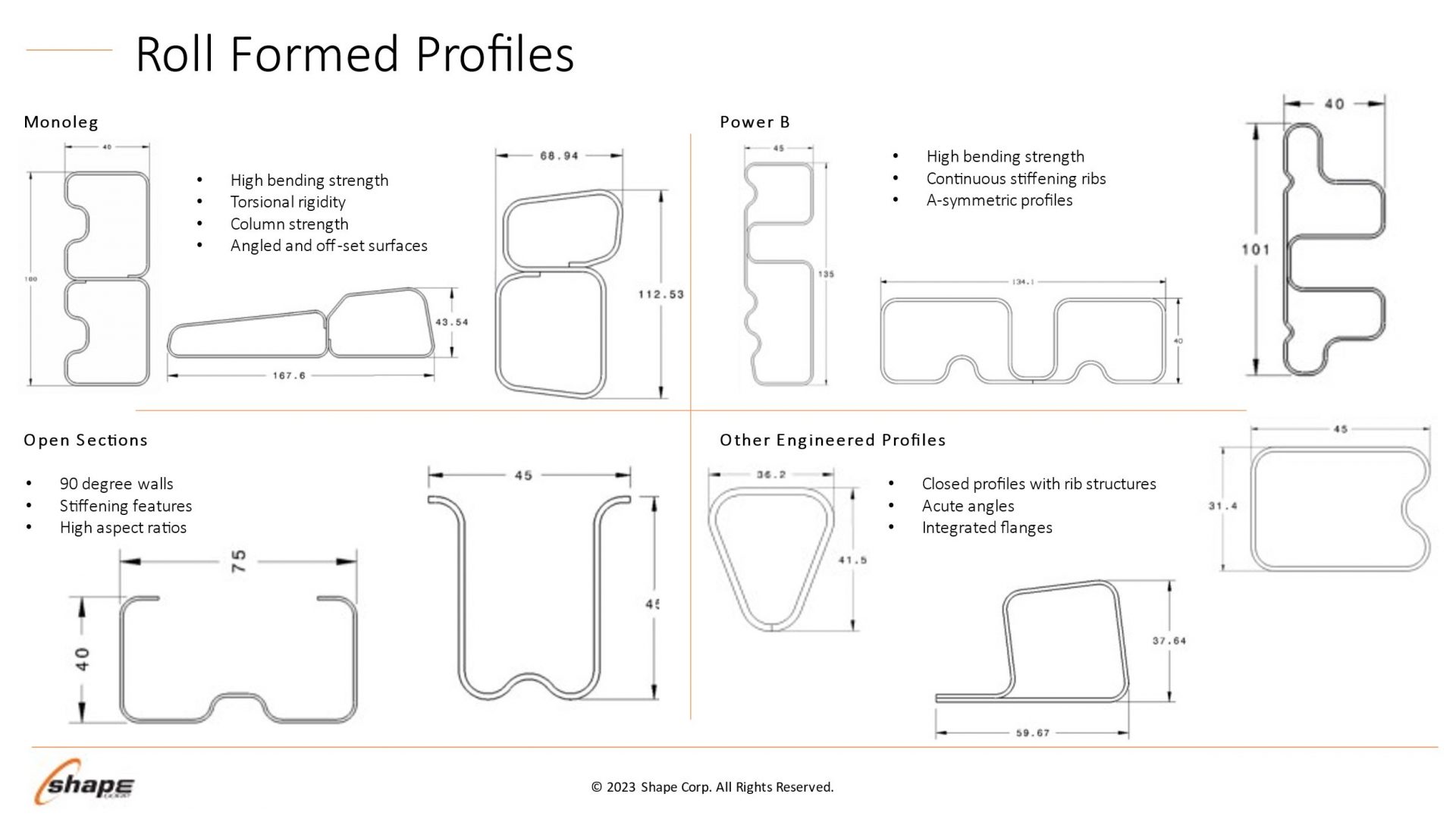

Roll forming is no longer limited to producing simple circular, oval, or rectangular profiles. Advanced cross sections such

as those shown in Figure 8 provided by Shape Corporation highlight some profile designs aiding in body structure

stiffness and packaging space reductions.

In summary, roll forming can produce AHSS parts with steels of all levels of mechanical properties and different microstructures with a reduced R/T ratio versus conventional bending. All deformation occurs at a radius, so there is no sidewall curl risk and overbending works to control angular springback.

Case Study: How Steel Properties Influence the Roll Forming Process

Many thanks to Brian Oxley, Product Manager, Shape Corporation, and Dr. Daniel Schaeffler, President, Engineering Quality Solutions, Inc., for providing this case study.

Optimizing the use of roll forming requires understanding how the sheet metal behaves through the process.

Making a bend in a roll formed part occurs only when forming forces exceed the metal’s yield strength, causing plastic

deformation to occur. Higher strength sheet metals increase forming force requirements, leading to the need to have

larger shaft diameters in the roll forming mill. Each pass must have greater overbend to compensate for the increasing

springback associated with the higher strength.

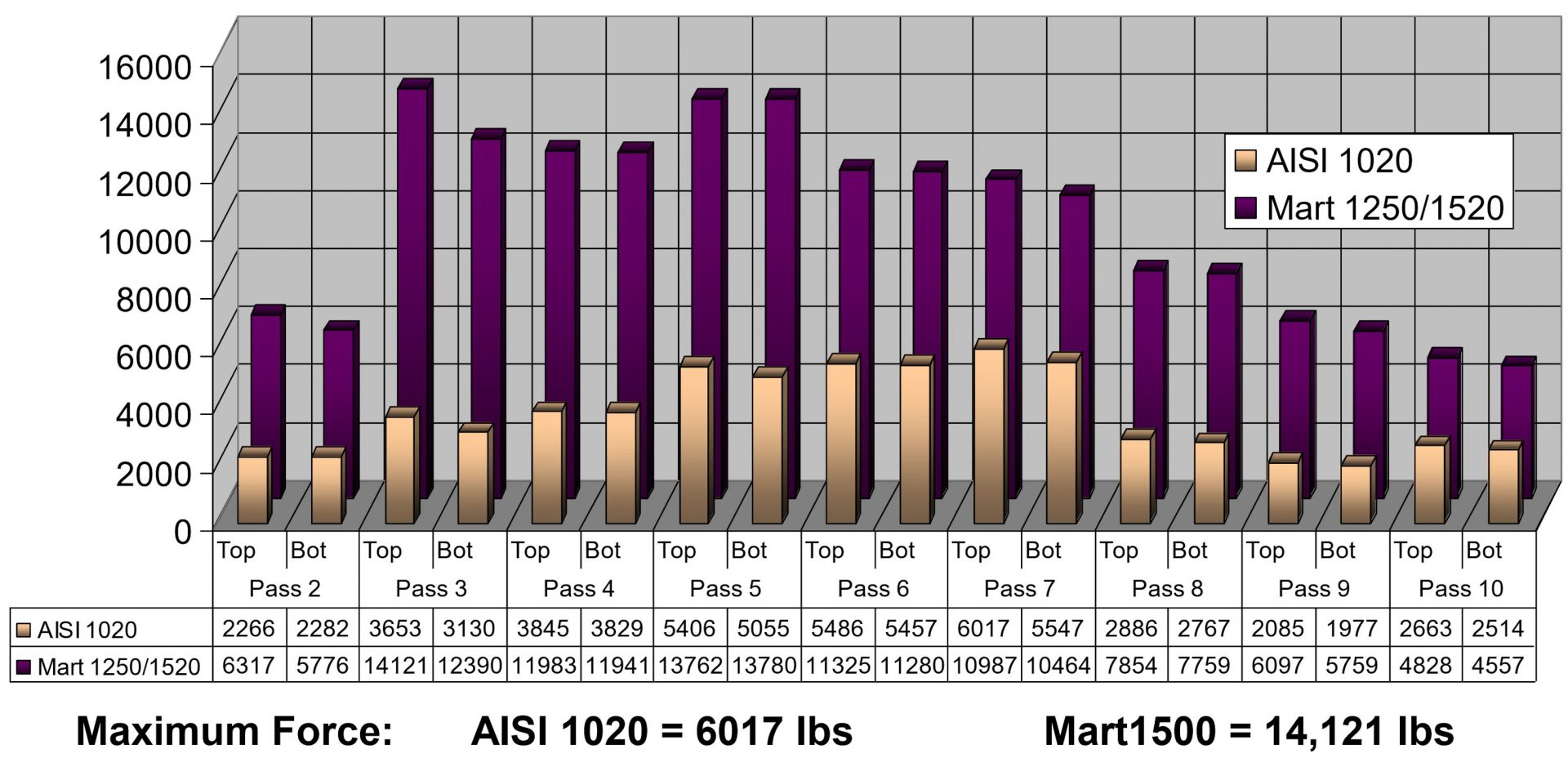

Figure 9 provides a comparison of the loads on each pass of a 10-station roll forming line when forming either AISI 1020

steel (yield strength of 350 MPa, tensile strength of 450 MPa, elongation to fracture of 15%) or CR1220Y1500T-MS, a

martensitic steel with 1220 MPa minimum yield strength and 1500 MPa minimum tensile strength.

Figure 9: Loads on each pass of a roll forming line when forming either AISI 1020 steel (450 MPa tensile

strength) or a martensitic steel with 1500 MPa minimum tensile strength. Courtesy of Roll-Kraft.

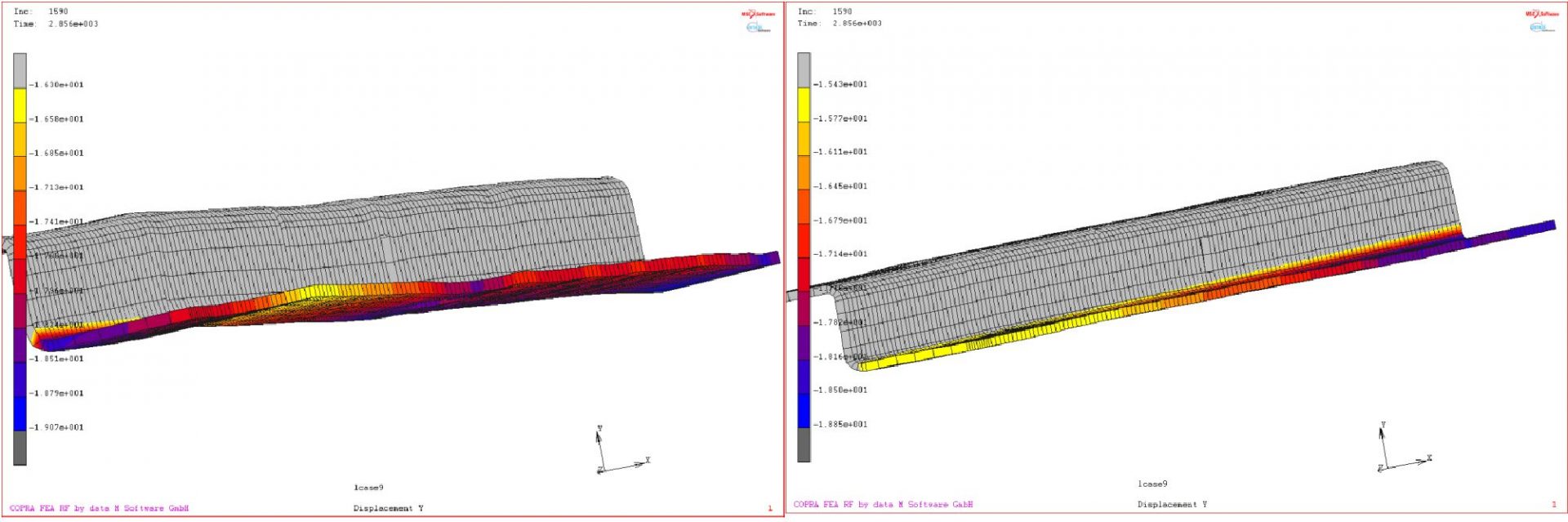

Although a high-strength material requires greater forming loads, grades with higher yield strength can resist stretching

of the strip edge and prevent longitudinal deformations such as twisting or bow. Flange edge flatness after forming

either AISI 1020 or CR1220Y1500T-MS is presented in Figure 10.

Figure 10: Simulation results showing flange edge flatness of a) AISI 1020 and b) CR1220Y1500T-MS.

Assumptions for the simulation: AISI 1020 yield strength = 350 MPa; CR1220Y1500T yield strength = 1220 MPa.

Higher yield strength leads to better flatness.

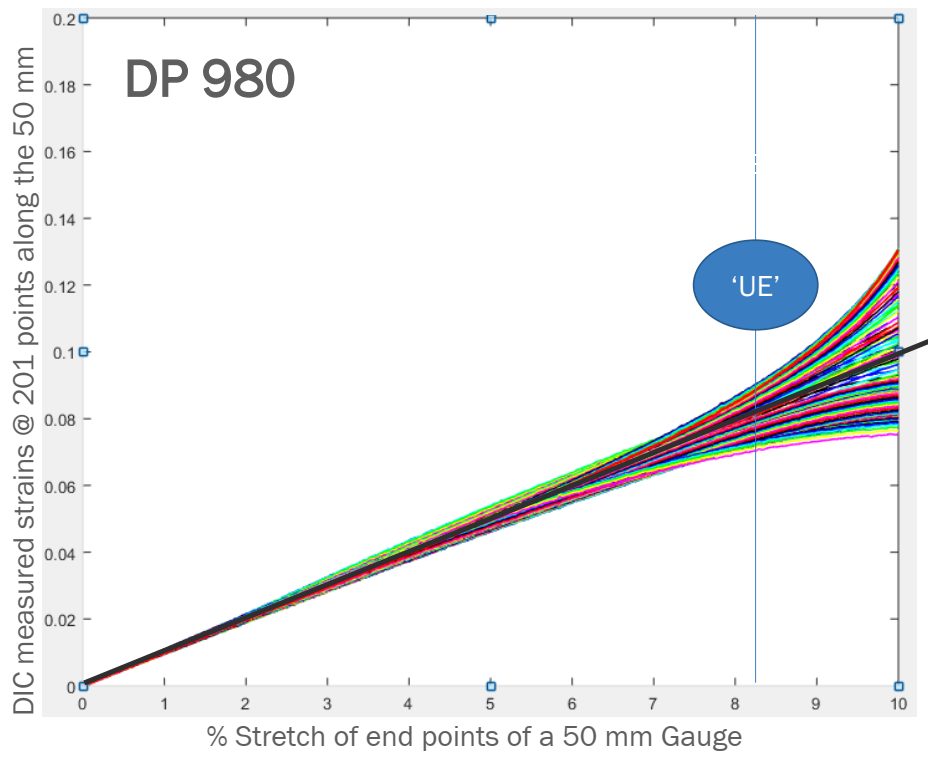

Force requirements for piercing operations are a function of the sheet tensile strength. High strains in the part design

exceeding uniform elongation resulting from loads in excess of the tensile strength produces local necking, representing

a structural weak point. However, assuming the design does not produce these high strains, the tensile strength has only

an indirect influence on the roll forming characteristics.

Yield strength and flow stress are the most critical steel characteristics for roll forming dimensional control. Receiving

metal with limited yield strength variability results in consistent part dimensions and stable locations for pre-pierced

features.

Flow stress represents the strength after some amount of deformation, and is therefore directly related to the degree of

work hardening: starting at the same yield strength, a higher work hardening steel will have a higher flow stress at the

same deformation.

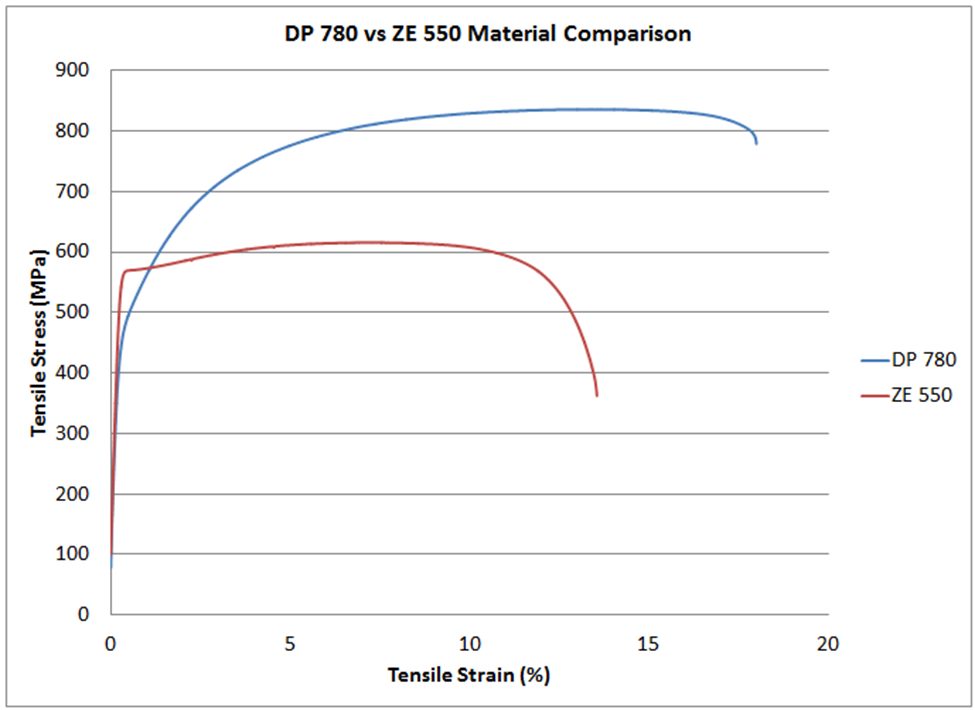

Two grades are shown in Figure 11: ZE 550 and CR420Y780T-DP. ZE 500, represented by the red curve, is a recovery

annealed grade made by Bilstein having a yield strength range of 550 to 625 MPa and a minimum tensile strength of 600

MPa, while CR420Y780T-DP, represented by the blue curve, is a conventional dual phase steel with a minimum yield

strength of 420 MPa and a minimum tensile strength of 780 MPa. For the samples tested, ZE 550 has a yield strength of

approximately 565 MPa, where that for CR420Y780T-DP is much lower at about 485 MPa. Due to the higher work

hardening (n-value) of the DP steel, its flow stress at 5% strain is 775 MPa, while the flow stress for the HSLA grade at 5%

strain is 620 MPa.

In conventional stamping operations, this work hardening is beneficial to delay the onset of necking. However, use of

dual-phase steels and other grades with high n-value can lead to dimensional issues in roll-formed parts. Flow stress in a

given area is a function of the local strain. Each roll station induces additional strain on the overall part, and strains vary

within the part and along the edge. This strength variation is responsible for differing springback and edge wave across

a roll-formed part.

Unlike conventional stamping, grades with a high yield/tensile ratio where the yield strength is close to the tensile

strength are better suited to produce straight parts via roll forming.

Figure 11: Stress-strain curves for CR420Y780T-DP (blue) and ZE 550 (red). See text for description of the grades.

Total elongation to fracture is the strain at which the steel breaks during tensile testing, and is a value commonly

reported on certified metal property documents (cert sheets). As observed on the colloquially called “banana diagram”,

elongation generally decreases as the strength of the steel increases.

For lower strength steels, total elongation is a good indicator for a metal’s bendability. Bend severity is described by the

r/t ratio, or the ratio of the inner bend radius to the sheet thickness. The metal’s ability to withstand a given bend can be

approximated by the tensile test elongation, since during a bend, the outermost fibers elongate like a tensile test.

In higher strength steels where the phase balance between martensite, bainite, austenite, and ferrite play a much larger

role in developing the strength and ductility than in other steels, bendability is usually limited by microstructural

uniformity. Dual phase steels, for example, have excellent uniform elongation and resistance to necking coming from

the hardness difference between ferrite and martensite. However, this large hardness difference is also responsible for

relatively poor edge stretchability and bendability. In roll forming applications, those grades with a uniform

microstructure will typically have superior performance. As an example, refer to Figure 11. The dual phase steel shown

in blue can be bent to a 2T radius before cracking, but the recovery annealed ZE 550 grade with noticeably higher yield

strength and lower elongation can be bent to a ½T radius.

Remember that each roll forming station only incrementally deforms the sheet, with subsequent stations working on a

different region. Roll formed parts do not need to use grades associated with high total elongation, especially since

these typically have a bigger gap between yield and tensile strength.

Coil Shape Imperfections Influencing Roll Forming

Along with the mechanical properties of steel, physical shape attributes of the sheet or coil can influence the roll

forming process. These include center buckle, coil set, cross bow, and camber. Receiving coils with these imperfections

may result in substandard roll formed parts.

Flatness is paramount when it comes to getting good shape on roll formed parts. Individual OEMs or processors may

have company-specific procedures and requirements, while organizations like ASTM offer similar information in the

public domain. ASTM A1030/A1030M is one standard covering the practices for measuring flatness, and specification

ASTM A568/A568M shows methods for characterizing longitudinal waves, buckles, and camber.

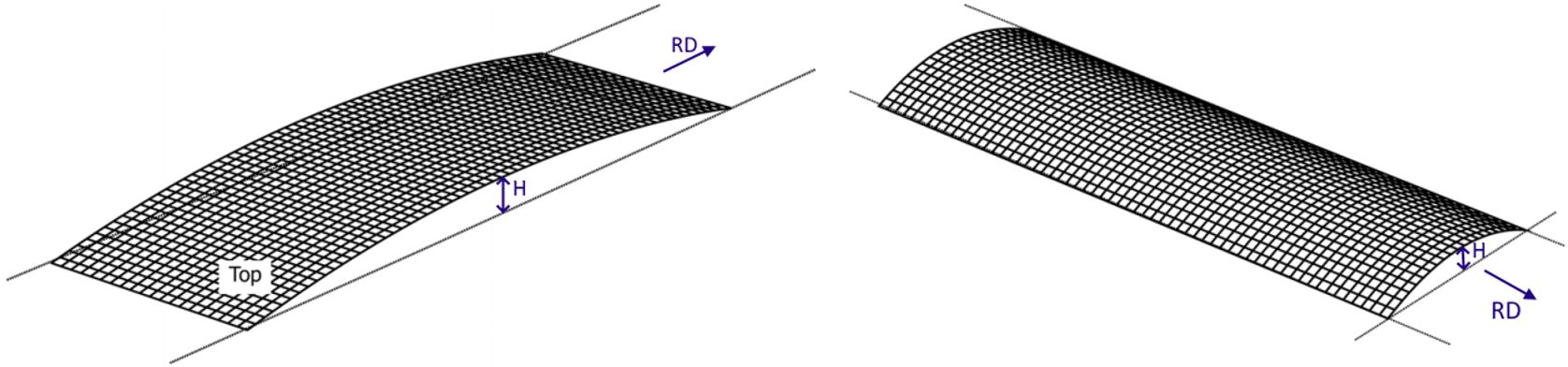

Center buckle (Figure 12), also known as full center, is the term to describe pockets or waves in the center or quarter

line of the strip. The height of pocket varies from 1/6” to 3/4”. Center buckle occurs when the central width portion of

the master coil is longer than the edges. This over-rolling of the center portion might occur when there is excessive

crown in the work roll, build-up from the hot strip mill, a mismatched set of work rolls, improper use of the benders, or

improper rolling procedures. A related issue is edge buckle presenting as wavy edges, originating when the coil edges

are longer than the central width position.

Coil set (Figure 13a), also known as longitudinal bow, occurs when the top surface of the strip is stretched more than the

bottom surface, causing a bow condition parallel with the rolling direction. Here, the strip exhibits a tendency to curl

rather than laying flat. To some extent, coil set is normal, and easy to address with a leveler. Severe coil set may be

induced by an imbalance in the stresses induced during rolling by the thickness reduction work rolls. Potential causes include different diameters or surface speeds of the two work rolls, or different frictional conditions along the two arcs

of contact.

Crossbow (Figure 13b) is a bow condition perpendicular to the rolling direction, and arcs downward from the high point

in the center position across the width of the sheet. Crossbow may occur if improper coil set correction practices are

employed.

Figure 13: Coil shape imperfections: A) Coil set and B) Crossbow A-30

Camber (Figure 14) is the deviation of a side edge from a straight edge, and results when one edge of the steel is

elongated more than the other during the rolling process due to a difference in roll diameter or speed. The maximum

allowable camber under certain conditions is contained within specification ASTM A568/A568M, among others.

Coil shape imperfections produce residual stresses in the starting material. These residual stresses combined with the

stresses from forming lead to longitudinal deviations from targeted dimensions after roll forming. Some of the resultant

shapes of roll formed components made from coils having these issues are shown in Figure 15. Leveling the coil prior to

roll forming may address some of these shape concerns, and has the benefit of increasing the yield strength, making a

more uniform product.

Figure 15: Shape deviations in roll formed components initiating from incoming coil shape issues:

a) camber b) longitudinal bow c) twist d) flare e) center wave (center buckle) f) edge wave. H-66

Roll Stamping

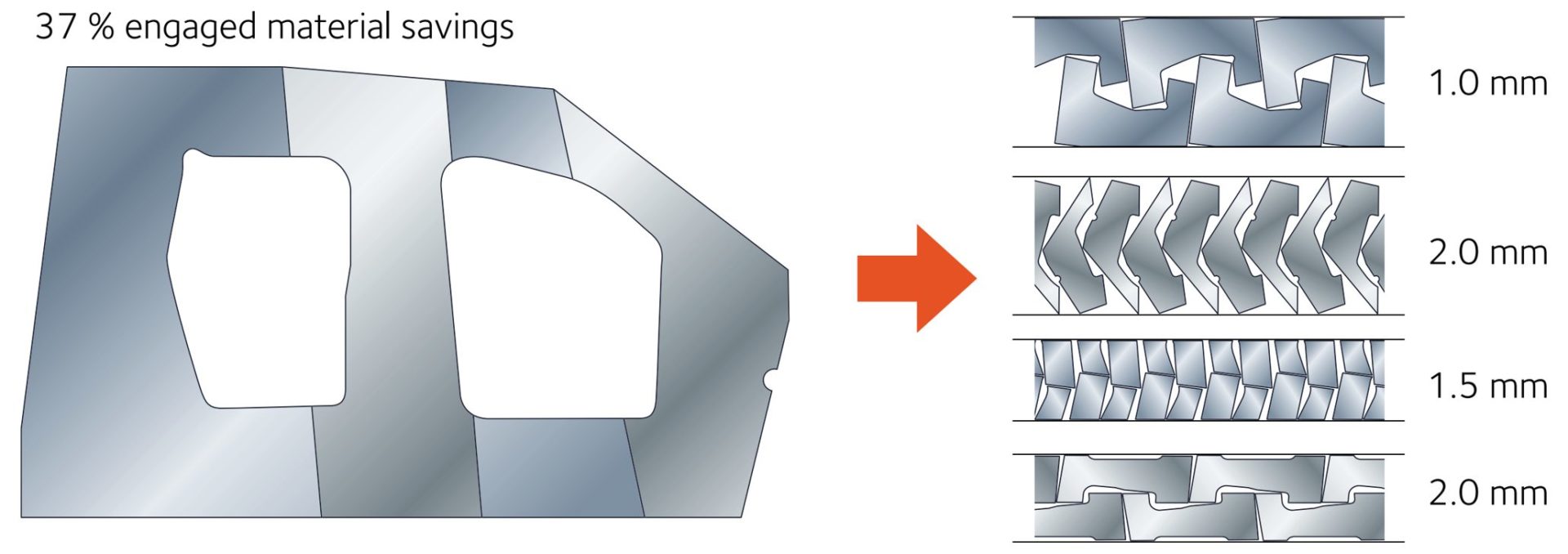

Traditional roll forming creates products with essentially uniform cross sections. A newer technique called Roll Stamping enhances the ability to create shapes and features which are not in the rolling axis.

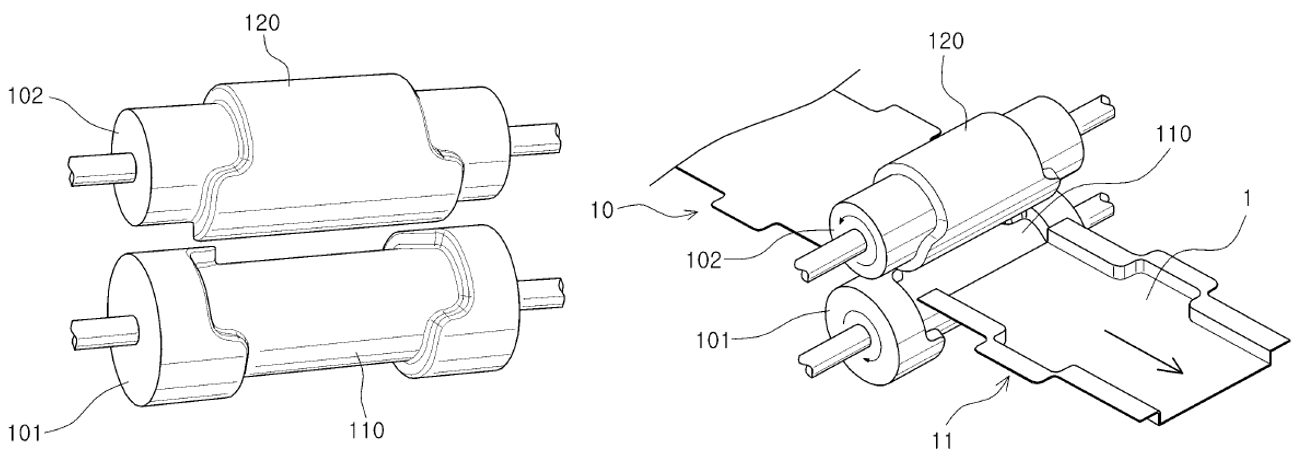

Using a patented processA-48, R-9, forming rolls with the part shape along the circumferential direction creates the desired form, as shown in Figure 16.

Figure 16: Roll Stamping creates additional shapes and features beyond capabilities of traditional roll forming. A-48

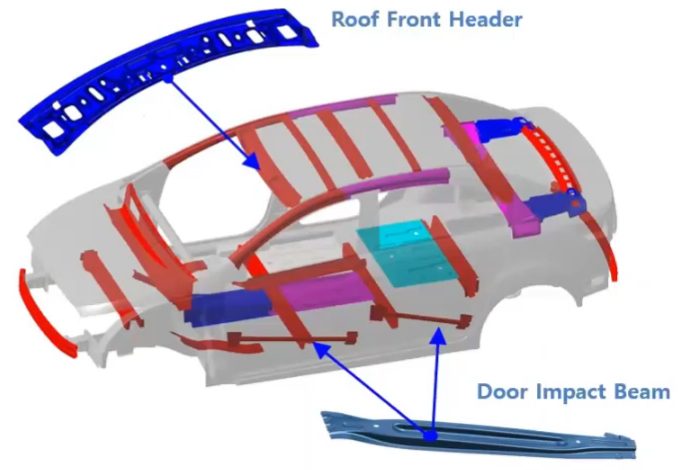

This approach can be applied to a conventional roll forming line. In the example of an automotive door impact beam, the W-shaped profile in the central section and the flat section which attaches to the door inner panel are formed at the same time, without the need for brackets or internal spot welds (Figure 17). Sharp corner curvatures are possible due to the incremental bending deformation inherent in the process.

Figure 17: A roll stamped door part formed on a conventional roll forming line eliminates the need for welding brackets at the edges.R-9

A global automaker used this method to replace a three-piece door impact beam made with a 2.0 mm PHS-CR1500T-MB press hardened steel tube requiring 2 end brackets formed from 1.4 mm CR-500Y780T-DP to attach it to the door frame, shown in Figure 18. The new approach, with a one-piece roll stamped 1.0 mm CR900Y1180T-CP complex phase steel impact beam, resulted in a 10% weight savings and 20% cost savings.K-58 This technique started in mass production on a Korean sedan in 2017, a Korean SUV in 2020, and a European SUV in 2021.K-58

Figure 18: Some Roll Stamping Automotive Applications.K-58

Thanks are given to Brian Oxley, Product Manager, Shape Corporation, for his contributions to the Roll Forming Case Study and Coil Shape Imperfections section. Brian Oxley is a Product Manager in the Core Engineering team at Shape Corp. Shape Corp. is a global, full-service supplier of lightweight steel, aluminum, plastic, composite and hybrid engineered solutions for the automotive industry. Brian leads a team responsible for developing next generation products and materials in the upper body and closures space that complement Shape’s core competency in roll forming. Brian has a Bachelor of Science degree in Material Science and Engineering from Michigan State University.

Thanks are given to Brian Oxley, Product Manager, Shape Corporation, for his contributions to the Roll Forming Case Study and Coil Shape Imperfections section. Brian Oxley is a Product Manager in the Core Engineering team at Shape Corp. Shape Corp. is a global, full-service supplier of lightweight steel, aluminum, plastic, composite and hybrid engineered solutions for the automotive industry. Brian leads a team responsible for developing next generation products and materials in the upper body and closures space that complement Shape’s core competency in roll forming. Brian has a Bachelor of Science degree in Material Science and Engineering from Michigan State University.